Planning for 2022: Key Deduction, Exemption, and Contribution Limits Increased by the IRS | SummitView Advisors | Financial Planning in Grand Rapids & Kalamazoo MI | CFP in Michigan

Tax Foundation on X: "The standard deduction will increase by $800 for joint filers, $600 for head of household filers, and $400 for single filers. https://t.co/ooGP5743Dv" / X

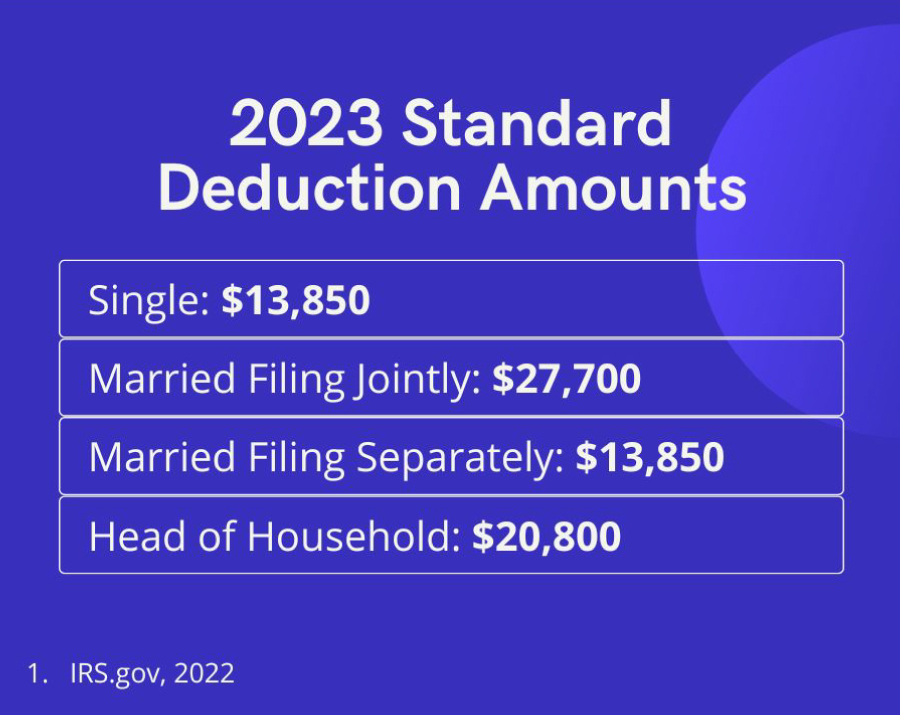

![How Tax Brackets Work [2023 Tax Brackets] | White Coat Investor How Tax Brackets Work [2023 Tax Brackets] | White Coat Investor](https://www.whitecoatinvestor.com/wp-content/uploads/2021/12/standard-deduction-2022.jpg)

:max_bytes(150000):strip_icc()/standard-deduction-3193021-FINAL-2020121-92f98d614dad4d72b36e54b867362f18.png)

:max_bytes(150000):strip_icc()/GettyImages-1301491715-e74fda1402e6477a9477bff256370b83.jpg)