What are the benefits of single member LLC electing S Corporation Tax Status? - Daniel Johnson Financial

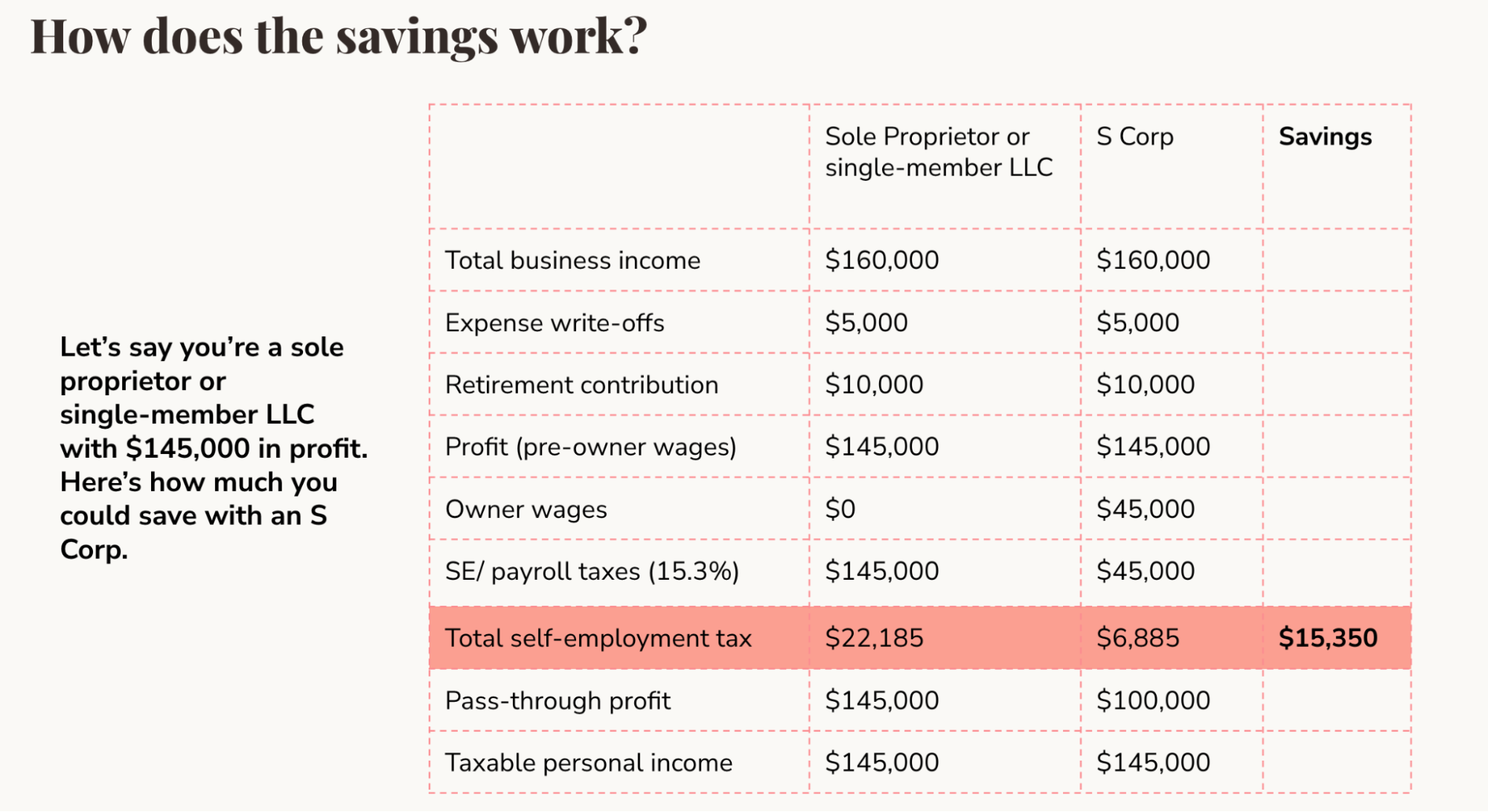

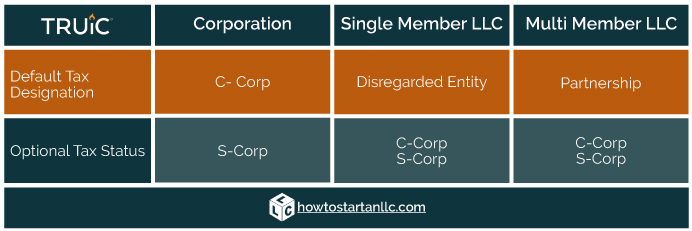

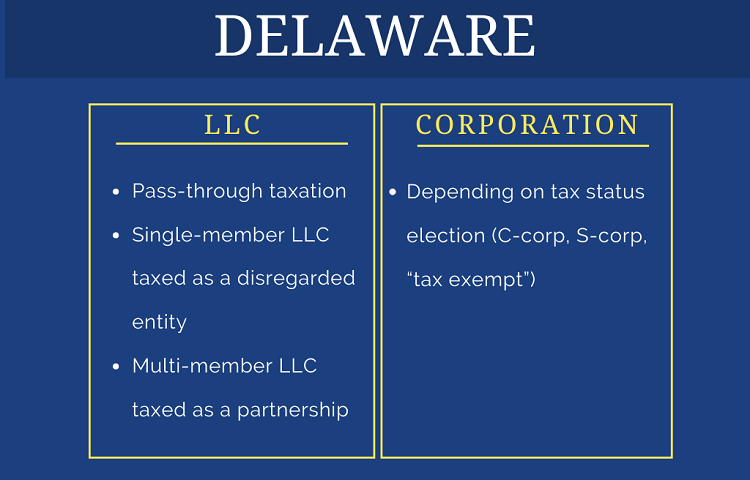

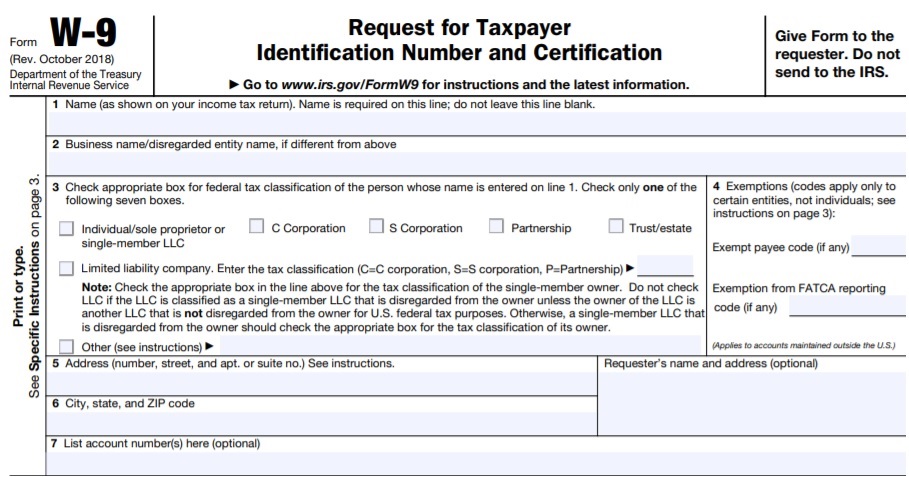

I was a single member LLC and have elected to become an S Corp. It makes my filings a bit more complex, but I do think is worth it in the…